Lhdn Benefit In Kind 2017

Benefits in kind 2 5.

Lhdn benefit in kind 2017. With effect from ya 2008 employees are given tax exemption on allowances benefits in kind and perquisites that received from their. Private use of company vans. Motorcar and other related benefits 7 1 1.

Benefits perquisites given to promote creativity and innovation. Travel passes or air miles. Non cash benefits except where specifically exempt or otherwise stated non cash benefits received from employment are recognised at market value or arm s length and taxed.

Ascertainment of the value of benefits in kind 3 6. 3 2017 income tax treatment of goods and services tax part iii employee benefits. 11 2012 employee share scheme benefit public ruling no.

Free use of assets other than accommodation company cars or vans employers in the car and motor industry. Accommodation facilities and vehicle related benefits are specifically provided for and valued as follows. These benefits are provided.

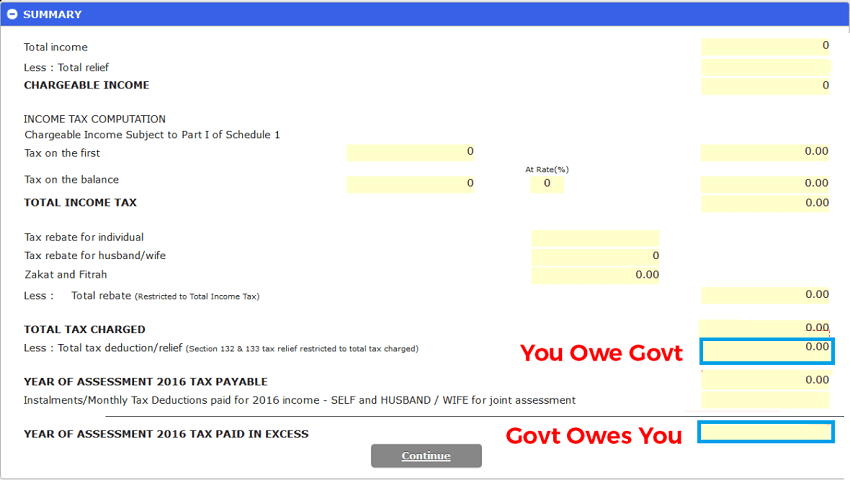

Particular benefit in kind 7 1. Employees responsibilities 23 11 monthly tax deduction 23 12. The formula method which uses this calculation.

Employer s responsibilities 22 10. These benefits are called benefits in kind bik. 2016 2017 malaysian tax booklet a quick reference guide outlining malaysian tax information the information provided in this booklet is based on taxation laws and other legislation as well as current practices including legislative proposals and measures contained in the 2017 malaysian budget announced on 21 october 2016.

Facility provided 2017 provision of accommodation value of tce. Value of asset lifespan of asset annual value of benefit. Generally non cash benefits e g.

These also count towards part of your income. There are two ways to determine the monetary thus taxable value of these benefits. There are several tax rules governing how these benefits are valued and reported for tax purposes.

This concession refers only to the medical bills of the employee employee s spouse and children. Accommodation or motorcars provided by employers to their employees are treated as income of the employees. Whichever method is used in determining the value of the benefit provided the basis of computing the benefit whether the formula method or the prescribed value method must be consistently applied throughout the period of the provision of the benefit.

Particulars of benefits in kind 4 7. Think of these as perks but ones that cannot be directly converted to cash. The benefits must be made available to all staff.

And one should also be awar. Free or subsidised accommodation. Tax exemption on benefits in kind received by an employee 14 9.

Private use of company cars. Deduction claim 24 13. Benefits perquisites relating to employee s health free or subsidised a outpatient treatment b hospitalisation c dental.

Gst borne by an employer b paragraph 13 1 b benefits in kind are benefits amenities not convertible into money.