Malaysia Income Tax Number Check

An income tax number or tax reference number is an unique identifying number used for tax purposes in malaysia.

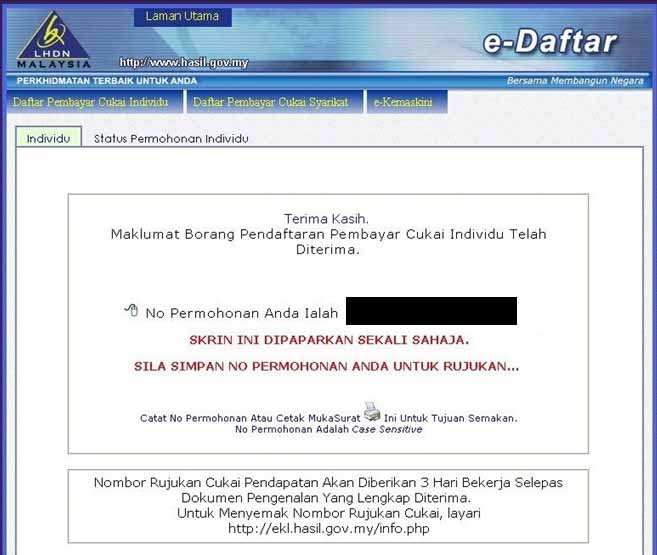

Malaysia income tax number check. Registering for a malaysian tax number is not very complicated. Please quote your application number problems complaints comments. Within 3 working days after completing an online application.

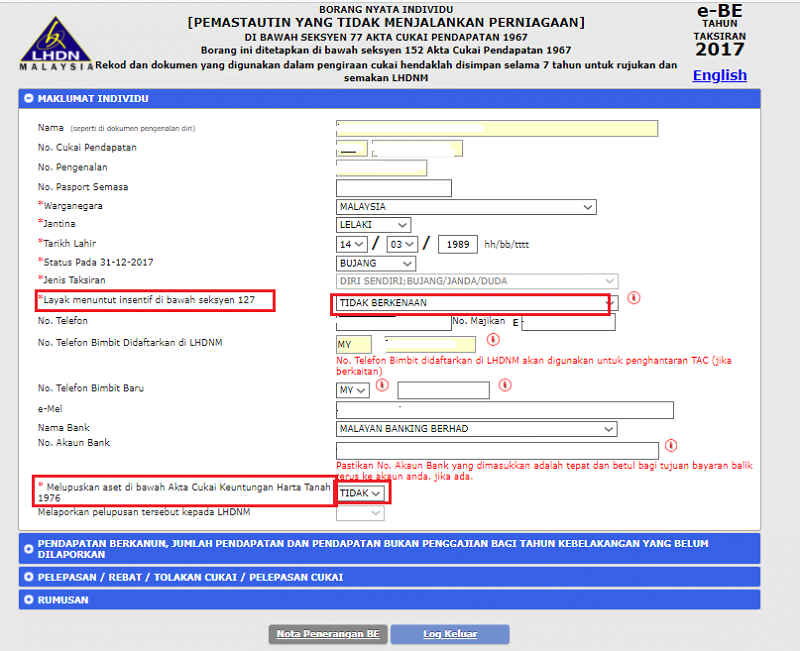

You can do the registration either on line or at the nearest branch of the malaysian inland revenue board irbm lembaga hasil dalam negeri malaysia. D payment via tele banking payment of individual income tax and real property gain tax rpgt can be made via tele banking service at bank agent as follow. Lembaga hasil dalam negeri malaysia classifies each tax number by tax type the most common tax reference types are sg og d and c.

If you were previously employed you may already have a tax number. 03 8911 1000 local number 603 7713 6666 overseas number not registered. Firstly go to the official website of the income tax department and click on the menu of itr v receipt status.

When will you get the income tax reference no. The most important thing is you will get a faster refund in case you paid excess income tax through pcb. Atm card from the respective bank to proceed with the payment and please provide your income tax reference number whenever requires to complete the transaction.

Semakan nombor cukai pendapatan individu lembaga hasil dalam negeri malaysia. This unique number is known as nombor cukai pendapatan or income tax number. Please used the given application number to check your application status.

Pengenalan kod keselamatan sila masukkan e mel dan nombor telefon yang. Check your application status. Malaysia information on tax identification numbers section i tin description malaysian income tax number itn the inland revenue board of malaysia irbm assigns a unique number to persons registered with the board.

You can check by calling the lhdn inland revenue board please have your ic or passport number ready. For a new taxpayer or existing taxpayer who would like to complete itrf for the first time there are a few steps you have to complete prior to filling the itrf form online through e filing. Kad pengenalan baru tanpa simbol seperti format berikut.

This is the responsible agency operated by the ministry of finance malaysia. The inland revenue board of malaysia malay. Input your pan and also your assessment year.

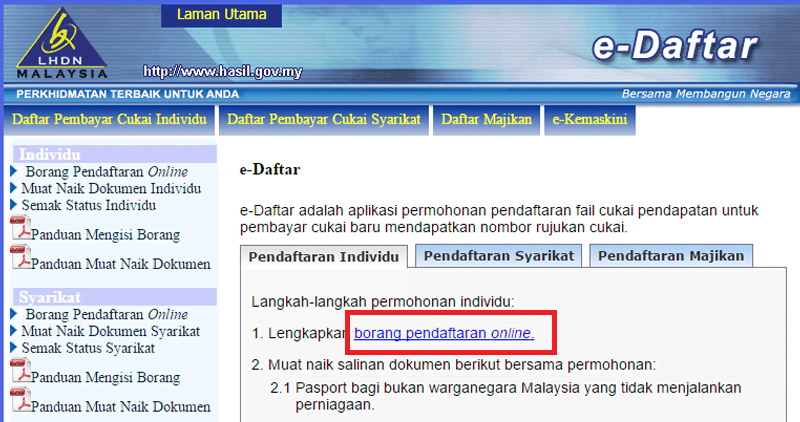

Also lhdn extended the dateline for extra 2 weeks. E daftar is an income tax file registration system for new taxpayer to get income tax reference number e data pcb for employer to check cp39 file format and upload the txt file to be submitted to lhdnm via online. Contact 03 8913 3800.

It is also commonly known in malay as nombor rujukan cukai pendapatan or no.